Gold holds near new record high, US labor data may spark fresh rally

Gold continued to trend higher and spiked to the highest levels since late April, just ticks under new record high on Monday.

Weaker dollar on growing bets for Fed’s September rate cut, following more dovish comments from US policymakers and fresh US political turmoil, along with darkened economic and geopolitical outlook, continue to fuel safe haven demand.

Markets await release of US jobs data (due on Friday) for the latest update from the US labor sector, which weakened significantly in past couple of months and is mainly behind Fed’s dovish stance lately.

New record high ($3500) marks very strong resistance which is likely to provide strong headwinds and probably keep the action capped until markets get fresh signals from US labor data.

According to the forecasts, situation in the US labor sector is unlikely to improve, as economists see NFP almost unchanged in August, while hiring in private sector is forecasted to drop and create new jobs too, that contributes to negative outlook.

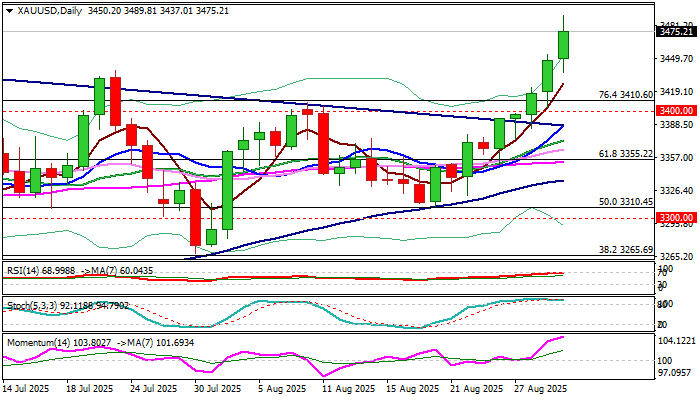

Overbought daily studies contribute to scenario of consolidation under new all-time high, while development of bullish continuation pattern on monthly chart suggests that bulls may resume after longer consolidation.

Gold may break into uncharted territory after a few month pause if data show persistent weakness in the labor sector that would further weaken the dollar.

Firm break of $3500 to expose projected targets at $3544, $3569 and $3600 (round-figure).

Former tops at $3452 and $3438 reverted to supports, with extended dips to hold above $3410/00 zone to keep larger bulls intact..

Res: 3489; 3500; 3544; 3569

Sup: 3453; 3438; 3410; 3400