Gold in quiet mode ahead of key US labor data

Gold is moving within a narrow range in European trading on Friday, but still being constructive after Thursday’s strong upside rejection at pivotal $3400 zone and daily close in red.

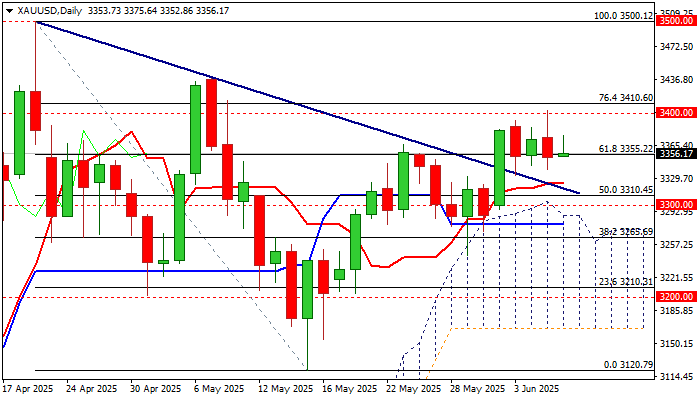

Near-term action stays around support at $3355 (broken Fibo 61.8%) and above 10DMA ($3335) which gives a dash of optimism, as several attacks already failed at this zone.

Technical structure on daily chart remains predominantly bullish (despite the evident loss of positive momentum) however, negative signals are developing on hourly chart (the price broke below the base of hourly Ichimoku cloud / 14-momentum is heading south and approaching the centreline), but this is initial signal that still requires confirmation.

Fundamentals are likely to be metal’s main driver again, after surprise talk between US President Trump and Chinese President Xi cooled trade fears and US jobless claims disappointed on jump to new multi-month high.

All eyes are on US May Nonfarm payrolls (130K f/c vs Apr 177K), with gold expected to receive strong boost if May numbers disappoint, while smaller negative impact could be expected on upbeat results.

The data are to provide more clues about the condition in the US labor market that will contribute to Fed’s short-term policy outlook.

First support lays at $3335 (10DMA) followed by $3318 (broken triangle’s upper trendline) and breakpoints at $3300 (psychological) and $3290 (daily cloud top).

Immediate resistance lays at $3368 (hourly cloud top, followed by $3375 (session high) and upper triggers at $3392 (Jun 3 high) $3400/03 (psychological / yesterday’s spike high) and $3310 (Fibo 76.4% of $3500/$3120 correction).

Res: 3375; 3403; 3410; 3437

Sup: 3335; 3318; 3300; 3290