Gold is set for further advance but possibility of early rate hike on surging inflation may limit gains

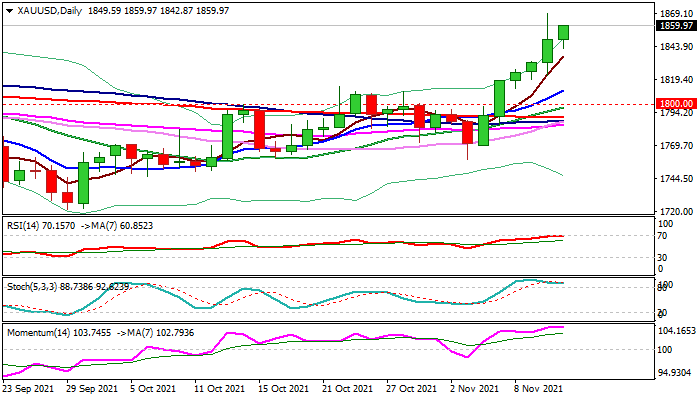

Spot gold extends advance into sixth straight day on Thursday and pressuring new 5-month high ($1868), posted on Wednesday, when metal’s price spiked after higher than expected us inflation data in October.

Rising consumer prices boost demand for gold as an inflation hedge, while a slowdown in the US and Chinese economies contributes to positive sentiment that could push the price much higher.

Bulls eye significant barriers at $1872/75 (weekly cloud top / 50% retracement of $2074/$1676, Aug 2020 / July 2021 correction), violation of which would unmask psychological $1900 level and May’s peak at $1916.

Bullish studies on daily and weekly chart support the action, which could be interrupted for consolidation due to overbought conditions, with dip-buying favored above former top at $1834.

However, traders need to remain cautious, as surging inflation may prompt earlier than expected rate hike that would weigh on yellow metal’s price.

Res: 1868; 1875; 1890; 1900

Sup: 1842; 1834; 1822; 1813