Gold – key $3000 support so far holds pullback from new record high

Gold holds within a narrow range at the beginning of the week but remains constructive above $3000 level (psychological / 10DMA).

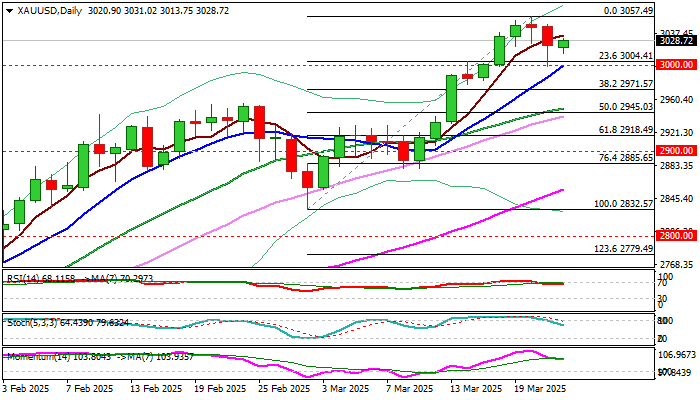

Recent pullback from new historical high ($3057) found firm ground at $3000 which was highlighted as strong support, with Friday’s strong rejection here, adding to significance of support.

Near-term action so far looks as consolidation ahead of fresh push higher after bullish stance was reinforced by weekly close above $3000.

Technical studies remain firmly bullish on daily chart, though overbought conditions may keep the price in prolonged consolidation, with potential dips below $3000 not ruled out.

Fundamentals are expected to remain a key driver, with hawkish Fed (kept rates on hold and signaled two 25bp rate cuts in 2025), escalating geopolitical situation and gloomy economic outlook, including threats that escalting trade war would fuel inflation, to contine to fuel safe haven demand.

On the other hand, hope that peace talks between USA, Russia and Ukraine would give some results and ease tensions, along with the latest softer rhetoric from President Trump regarding tariffs (due to be imposed on Apr 2) would contribute to easing high uncertainty and negatively slow migration into safety.

Near term action is to remain biased higher while $3000 support holds, with sustained break above cracked $3029 barrier (50% retracement of $3057/$2999 pullback) needed to verify bullish signal.

Conversely, loss of $3000 handle would sideline bulls and open way for deeper pullback, which should find footstep above $2971 (Fibo 38.2% of $2832/$3057 bull-leg) to mark a healthy correction and keep larger bulls intact.

Res: 3035; 3047; 3057; 3079

Sup: 3013; 3000; 2971; 2956