Gold – no significant changes despite overheated geopolitics

Gold edged lower on Monday after opening with some $20 gap higher at the start of the week, on concerns that the war in the Middle East could run out of control after US attacked Iran over the weekend.

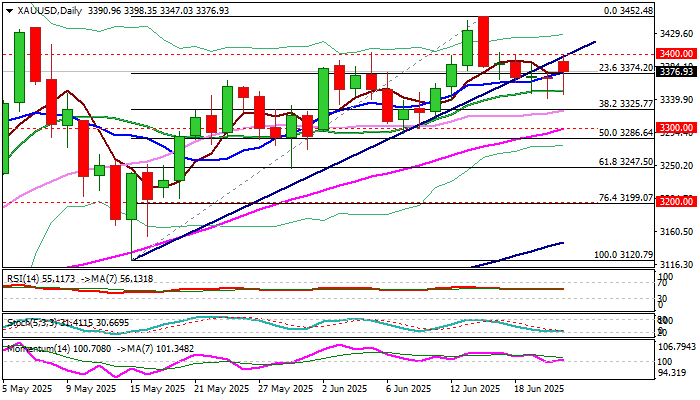

Fresh advance reached levels ticks away from pivotal $3400 barrier (psychological / broken trendline support, reverted to resistance) but lacked strength for break higher.

Markets did not find the fresh escalation over the weekend sufficient to spark stronger rally into safety, with traders remaining cautious and more sidelined while waiting for signals from the battlefield.

Gold price moved within limited range on Monday but in defensive as long as it is capped under $3400.

On the other hand, immediate downside risk is likely to be limited as long as the price holds above 20DMA ($3352) which tracks the action and holds for one month.

Daily studies are in almost full bullish setup, with larger uptrend being still intact that contributes to scenario of a healthy correction preceding fresh push higher.

The notion is supported by persistent uncertainty and fears that the conflict may escalate further as Iran said it will retaliate to US attack.

Bullish scenario requires a clear break of $3400 trigger to shift near-term focus higher and open way for attack at next strong barriers at $3450 zone ($3446/$3450, tops of May 13/17) guarding key resistance at $3500 (new record high).

Conversely, loss of 20DMA would soften near-term structure and open pivotal Fibo support at $3325 (38.2% retracement of $3120/$3452), guarding lower triggers at $3300/$3286 (psychological 50% retracement) loss of which would put bulls on hold and make the downside more vulnerable.

I would like to suggest to traders to be extra cautious and sometimes think ‘out of the box’ in situations like it is now.

Also to take an action when they get clear and confirmed signal, as recent movements showed that bullion reacted either mildly or opposite to wide expectations, signaled by fundamentals in a number of most recent situations.

Res: 3400; 3414; 3437; 3452

Sup: 3340; 3352; 3340; 3325