Gold price surges on fresh tariff worries, geopolitical factors

Gold opened with gap higher and surged in early Monday trading, lifted by escalation of war in Ukraine, President Trump’s fresh threats of doubling current tariffs on imports of steel and aluminium and victory of Eurosceptic candidate in Poland’s Presidential election.

Worsened conditions provided fresh boost to safe haven demand, with gold price advancing nearly 1.8% since opening today.

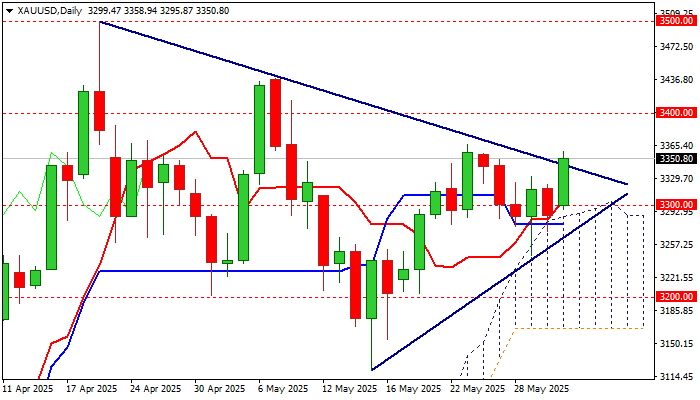

Bulls pressure key barrier at $3365 (May 23 high), break of which to signal an end of near-term corrective phase ($3365/$3245) and further brighten near-term outlook, with targets at $3400 (round figure) and $3437 (May 7 lower top) expected to come in focus.

Daily studies turned to full bullish setup, with thick rising daily cloud (which contained several attack recently) continuing to underpin, along with diverging daily Tenkan/Kijun-sen, after formation of bull-cross, with breach of the upper boundary of triangle ($3343) contributing to positive signals.

Corrective action should be anticipated in the near term as hourly studies are strongly overbought, with dips likely to shallow in current strongly bullish sentiment.

Broken triangle’s upper trendline turned to initial support, followed by supports at $3330/20 zone, which should ideally contain dips and keep fresh bulls intact.

Res: 3358; 3365; 3400; 3414

Sup: 3343; 3330; 3322; 3311