Gold price tumbles on ceasefire talks after a muted reaction on conflict escalation in past two days

Gold fell to two-week low on Tuesday after the metal showed a mild reaction as a safe haven on US involvement in Israel-Iran conflict on the side of Israel and failed to react on late Monday’s Iranian attacks on US military bases in Qatar and Iraq.

But gold price fell sharply overnight, initially on signals that there was no significant damage from Iran’s missile attack on US bases and on announcement of a ceasefire that was supposedly asked by both sides, with US President Trump being a mediator.

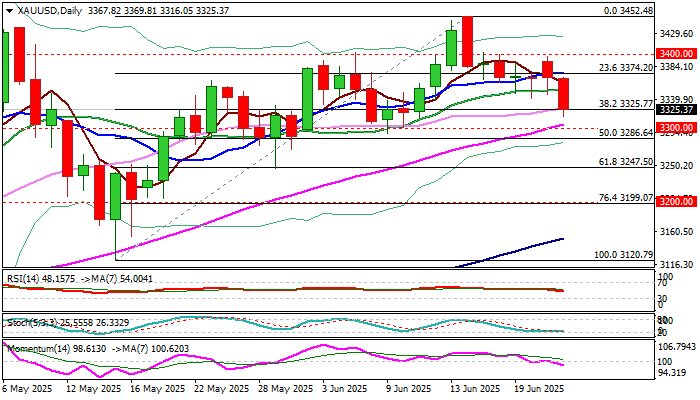

The latest acceleration cracked important Fibo support at $3325 (38.2% of $3120/$3452) loss of which would further weaken near-term structure and risk attack at pivotal $3300/$3286 zone (psychological / 50% retracement).

Weakening technical picture on daily chart (strengthening negative momentum / 10/20DMA in bearish setup) supports such scenario, although some profit taking is likely to be seen before bears regain power.

Initial resistances lay at $3352/57 (20DMA hourly lower top), followed by $3374 (10DMA) and $3400 zone (upper breakpoint).

Res: 3352; 3374; 3400; 3414

Sup: 3316; 3300; 3286; 3247