GOLD – pullback from new record high runs out of steam ahead of key US data

Gold price edges higher in European trading on Monday, after Monday’s Doji candle signaled that pullback from new record high ($2483) might be running out of steam.

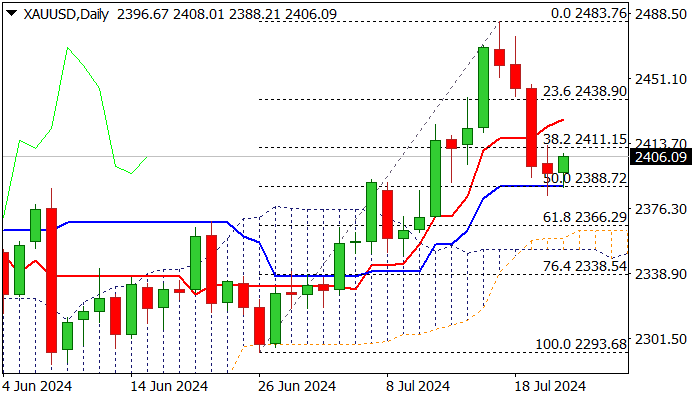

Pullback was contained by solid supports at $2390 zone (daily Kijun-sen / 50% retracement of $2293/$2483 upleg), with oversold conditions on daily chart and indicators predominantly in bullish setup, contributing to initial signal of an end of corrective phase.

However, fundamentals are expected to play the key role in defining metal’s near term direction, with US Q2 GDP and June PCE data, being in focus.

Investors will be looking for more information about the condition of the US economy, as well as signals about timing of start of Fed’s rate cuts from inflation numbers.

Lift above daily Tenkan-sen ($2427) is seen as minimum requirement for recovery to generate firmer bullish signal and spark further recovery.

Otherwise, the price may hold in extended consolidation with risk of fresh attempts through $2390 pivot, though larger bullish bias will remain while the price stays above daily cloud top ($2363).

Res: 2411; 2421; 2427; 2445

Sup: 2388; 2366; 2363; 2352