Gold – renewed safe haven demand lifts gold price further

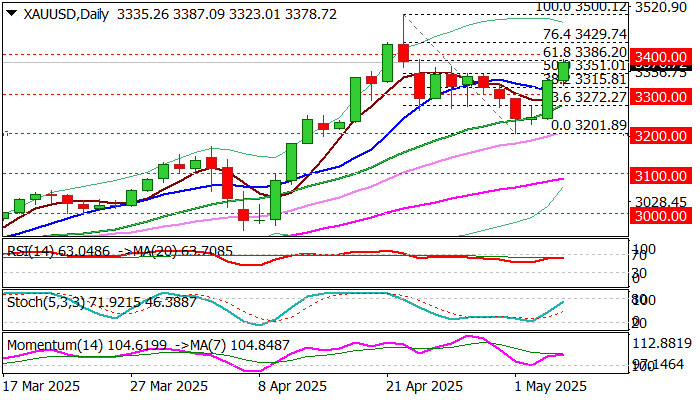

Gold extends strong recovery into second consecutive day and hit two week high on Tuesday, as fresh extension higher cracks Fibo 61.8% of $3500/$3201 pullback ($3286) and near psychological $3400 barrier.

Fresh rise in safe haven demand on renewed concerns about trade conflict with China and worsening geopolitical situation, lifted metals’ price and signaling that pullback from new record high was a healthy correction, which is likely over.

This adds to signals that larger uptrend remains intact and fragile economic and geopolitical situation will continue to fuel migration into safety, implying that gold may rise well above current peak.

Markets also focus on Fed’s policy decision on Wednesday, with wide expectations for unchanged rates at the May meeting and wait for signals about the rate trajectory in the near term from Fed Chief Powell’s press conference.

Technical picture on daily chart is again firmly bullish, with close above $3351 (50% retracement) seen as minimum requirement to validate positive signal and further strengthen near term structure.

Violation of $3386 and $3400 (Fibo 61.8% / psychological) to open way for fresh attack at key $3500 barrier.

Res: 3387; 3400; 3430; 3450

Sup: 3351; 3315; 3300; 3272