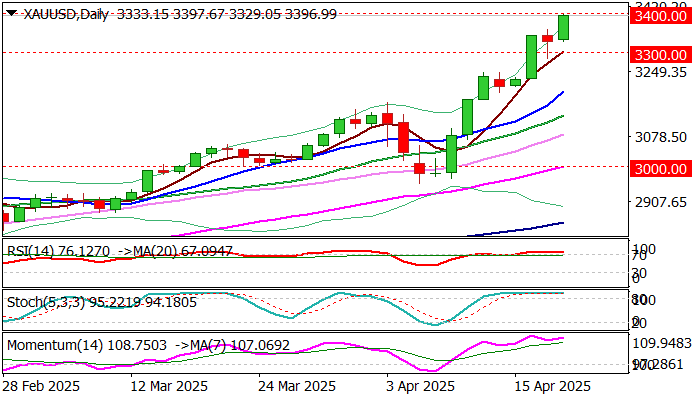

Gold resumes rally after a brief holiday pause and nears $3400 target

Markets are back to business and accelerated in unchanged direction after short Easter break.

Gold jumped around 1.8% in Asian/early European trading, hitting series of new record highs and pressuring psychological $3400 level.

Fresh safe haven demand was sparked on growing uncertainty over escalation of US-China trade war and China’s warning to countries against striking economic deal with the US.

Clouded US economic outlook and fresh tensions over President Trump’s attack against Fed Chair Powell, added to migration from US dollar and further inflated gold price.

Fresh gains came just ticks ahead of $3400 level, where headwinds are expected as daily studies are strongly overbought, while hourly indicators form initial reversal signal (momentum and stochastic bearish divergence).

However, due to strong and unchanged supportive factors (fundamentals) dips are likely to be shallow, with support at $3360 zone and session low ($3329) marking solid supports which should contain and guard more significant $3300 support.

Final break of $3400 to expose targets at $3428 and $3459 (Fibo projections).

The latest rallies signal that bulls already eye target at $3500, against my recent forecast that gold would hit $3500 by the end of the year.

The metal’s price holds in steep and accelerating uptrend for the fourth consecutive month, adding to signals of possible much stronger than expected gains in the near future.

Res: 3400; 3428; 3459; 3500

Sup: 3369; 3357; 3329; 3300