Gold rises on geopolitical tensions / Fed rate cut prospects

Gold hit one-week high early Thursday, in extension of Wednesday’s nearly 1% advance when gold price was inflated by softer than expected US inflation numbers that boosted bets for Fed rate cuts and weakened dollar.

Escalation in geopolitics after Israel threatened of attacking Iran caused fresh rally into security and lifted gold price away from critical $3000 support zone, shifting near term focus to the upside.

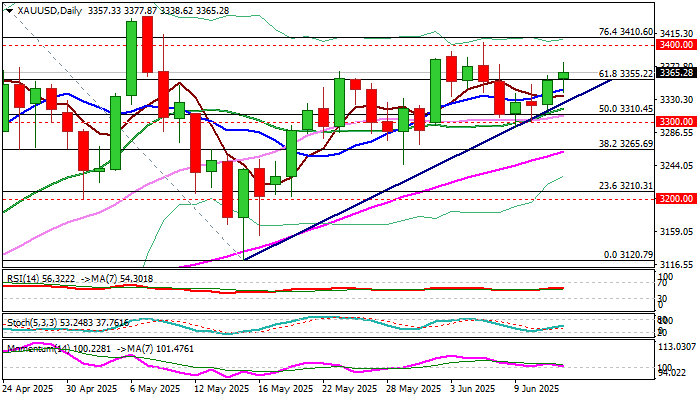

Quick pullback from new high ($3377) reached $3338 low but repeatedly closed above important Fibo support at $3345 (38.2% of $3293/$3377 upleg, reinforced by rising 200HMA) on hourly chart.

Subsequent strong bounce adds to hopes that pullback was temporary and positioning for fresh push higher as technical picture on hourly chart is predominantly bullish.

Fresh recovery needs a clear break above cracked $3360 zone (Fibo 61.8% of $3377/$3338 bear-leg) to verify positive signal.

Regain of session high $3377 to open way for another attack at $3400 zone (psychological / June 6 peak), violation of which to further improve the picture on daily chart and expose key target at $3500 (new record high).

Caution on dip below 20HMA ($3355) that would make the downside more vulnerable and keep lower triggers at $3340 zone and $3327 (trendline support) at increased risk.

Res: 3377; 3400; 3410; 3437

Sup: 3345; 3338; 3327; 3310