Gold stays afloat near $4K but still lacks direction signals

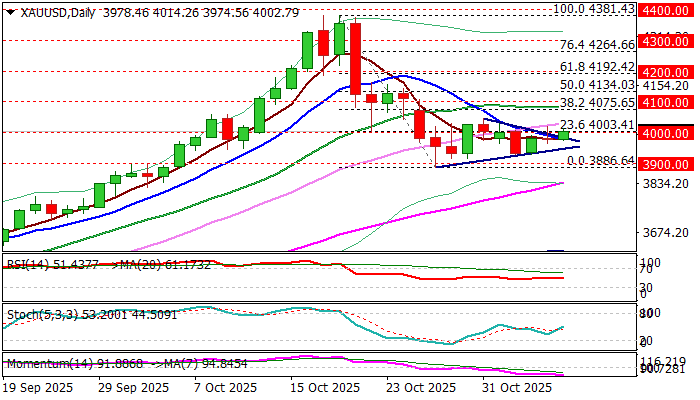

Gold price edged higher on Friday, in a second attempt to clearly break above pivotal barriers at $3986 (tringle’s upper boundary) and $4000 (psychological) after Thursday’s action spiked to $4019 but failed to register daily close above these levels.

Gold remains afloat due to weaker dollar on renewed speculations about Fed rate cut in December, though support was so far insufficient to spark stronger recovery.

Near-term price action wobbles around $4000 handle, with attempts to emerge above the triangle and eventually clear $4000 barrier, after last week’s action has registered a marginal close above this level (at $4002).

Conflicting daily studies lack direction signal (negative momentum / rising stochastic / neutral RSI) that keeps the price within a narrow range for the second straight day.

Initial positive signal would be weekly close above $3986/$400, though more work at the upside (minimum break above Thursday’s peak at $4019) will be required to confirm signal and expose upper breakpoints at $4046 (recent range top) and $40.75 (Fibo 38.2% of $4381/$3986 pullback).

Conversely, closing below yesterday’s low ($3964) would sour the sentiment, while breach of triangle’s support line ($3948) would weaken near-term structure and risk renewed attempts through $3900 support.

Res: 3955; 3977; 4000; 4020

Sup: 3985; 3964; 3948; 3928