Gold surges to $3500

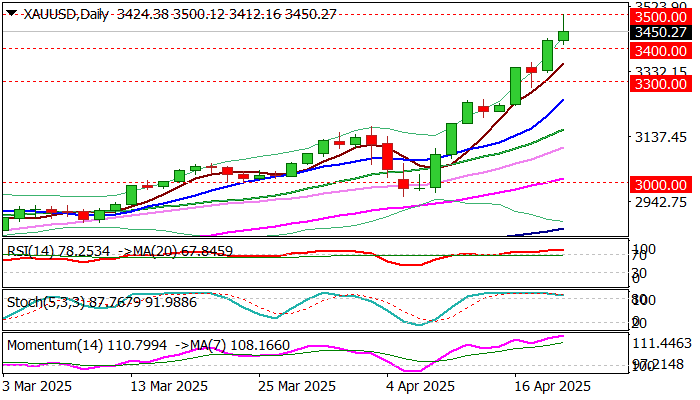

Gold skyrocketed since Monday’s opening ($3333) and hit $3500 on Tuesday morning, advancing 5% in slightly more than 24 hours.

It seems that rally since the start of the year is unlikely to slow but continues to accelerate (gold was up around 33% from January 1 until today) as conditions continue to deteriorate that fuels demand for safe-haven yellow metal.

Many analysts saw $3500 level as target for this year and I joined this expectations, anticipating that euphoria over Trump’s radical measures was about to start fading, with expected peace talks in Ukraine, adding to scenario.

However, recent waves of trade tariff stories, particularly on deepening crisis between the US and China, world’s two largest economies, and Trump’s latest attempt to fire the first man of the US Federal Reserve that strongly undermined investors’ confidence in the US economy, sparked further migration into safety, which shows no signs of ending so far.

Touch of $3500 was followed by sharp pullback, partially due to significance of this level, but more due to strongly overbought daily studies which warn that bulls may take a breather for consolidation and positioning for renewed attack at $3500 barrier.

Monday’s high ($3430) and today’s session low ($3412) mark initial support, along with psychological $3400 level, which should ideally contain pullback and keep larger bulls intact, while loss of $3400 handle would signal deeper correction, and expose supports at $3350/$3330 and $3300.

Res: 3466; 3500; 3521; 3535

Sup: 3430; 3412; 3400; 3450