GOLD takes a breather after recent rally but bulls remain in control above $4100

Gold price holds in consolidating mode for the second consecutive day, as bulls take a breather after strong rally on Monday, which broke above some key barriers and generated fresh bullish signals.

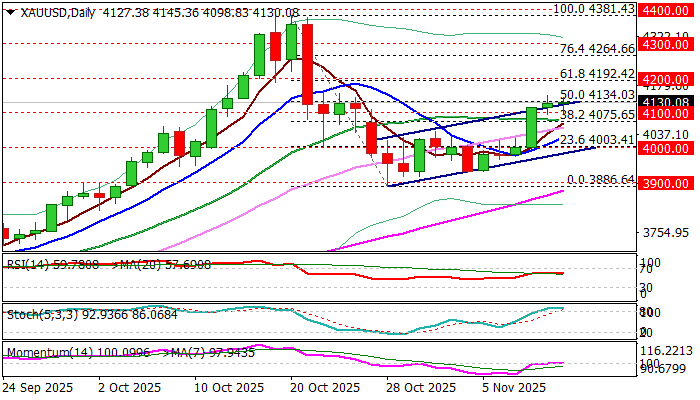

Very limited profit taking keeps the price afloat above $4100 (reverted to solid support) while upticks were capped at $4145 and so far unable to register close above cracked important Fibo resistance at $4134 (50% retracement of $4381/$3886 / daily Kijun-sen / bull-channel upper boundary), clear break of which to spark fresh acceleration higher.

Daily studies show MA’s in full bullish setup but countered by 14-d momentum stuck at the centreline and overbought stochastic that currently lacks clear near-term direction signal.

However, the metal’s price holds steady after the latest rally that contributes overall bullish bias and keep focus at the upside.

Pause in the latest recovery was mainly caused by expectations of the US House vote on a deal to reopen the government and release delayed economic data which would provide more details about the condition of the US economy and Fed’s monetary policy path.

Bullish scenario sees sustained break of $4134 as a catalyst for fresh advance towards $4192/$4200 (Fibo 61.8% / psychological) and $4264 (Fibo 76.4%) in extension.

Broken $4100 level should ideally hold dips and guard a lower breakpoint at $4075 (broken Fibo 38.2% / 20DMA) loss of which will be bearish.

Res: 4100; 4134; 4150; 4192

Sup: 4100; 4075; 4046; 4038