Oil price climbs to 13-month high, lifted by demand recovery optimism and production cuts

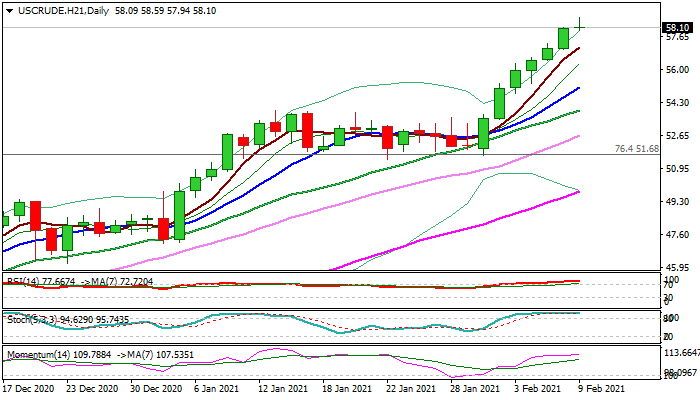

WTI oil rose above $58 per barrel on Tuesday, hitting the highest in 13 months and establishing in the zone where it traded before the pandemic.

Oil price rises for the seventh straight day, with last week’s rally being the biggest since the last week of March.

Fresh risk appetite in the market adds to oil’s positive sentiment, boosted by optimism over a recovery in fuel demand and supply cuts by major producers.

Bullish daily studies underpin the action, also attracted by monthly cloud twist ($59.54) but strongly overbought RSI and Stochastic warn that bulls may position before attack at psychological $60 barrier.

Rising 10DMA ($55.09) and Feb 2020 high ($54.62) mark solid supports, with deeper dips expected to stall on approach to broken 200WMA ($53.21, reverted to strong support) to keep bulls in play.

Res: 58.59; 58.86; 59.54; 60.00

Sup: 57.94; 57.11; 56.43; 55.28