Oil price rises nearly 4%, key barriers under pressure

WTI oil price jumped around 3.7% and hit the highest in almost two weeks on Monday, on track for the biggest daily gain since April 9.

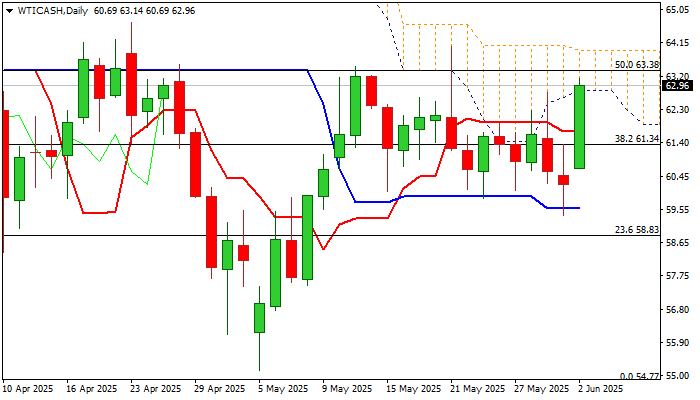

Fresh advance penetrated daily cloud (spanned between $62.83 and $63.92) and cracked psychological $63.00 level.

Near term focus shifts to key resistances at $63.92 /$64.03 (cloud top / ceiling of recent four-week congestion) break of which to generate stronger bullish signal for continuation of recovery from $55.14 (May 5 low).

Technical picture on daily chart is improving, as momentum studies are turning positive and daily Tenkan/Kijun-sen are in bullish configuration and below the price, but more work at the upside is still required to further firm the structure.

Sustained break of pivotal $64.00 zone to expose targets at $64.70 (April 23 top) and $65.00 (psychological).

Hourly higher base at $61.68 offers solid support which should contain dips and guard $61.34 (broken Fibo 38.2% of $71.98/$54.77, reinforced by 10DMA),

Res: 63.14; 63.38; 64.03; 64.70

Sup: 62.24; 62.00; 61.68; 61.34