Oil price rises on renewed demand optimism but key barriers still hold

Strong bullish acceleration on Monday (WTI contract was up around 3% in Asia / Europe) retraced close to 50% of last week’s 8.5% drop, as sentiment improved on China’s opening its borders that brightened the outlook for oil demand, while weaker dollar also contributed to higher oil prices.

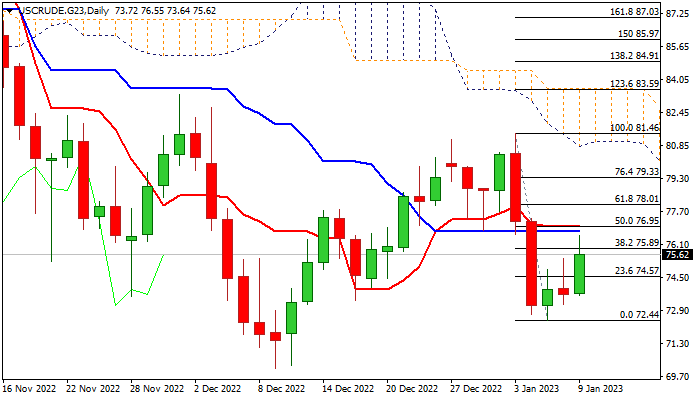

Technical studies on daily chart are improving as 14-d momentum is breaking into positive territory and stochastic emerged from oversold zone, though moving averages are still in bearish configuration.

Pivotal barrier lays at $76.70/95 zone (converged daily Tenkan-sen / Kijun-sen) and sustained break here is needed to generate reversal signal and open way for stronger recovery, while holding below these resistances would keep the downside vulnerable.

Res: 75.89; 76.70; 76.95; 78.01

Sup: 74.57; 73.64; 73.22; 72.44