Oil prices dip sharply as no immediate threats on global supply fade bullish sentiment

WTI oil price fell over 6% until early US session on Monday, as traders collected profits from last week’s almost 13% rally.

Oil was lifted by easing trade tensions between US and China that boosted expectations of stronger economic growth and subsequent rise in demand and escalation of Israel-Iran conflict which fueled fears of spreading conflict through sensitive Middle East region.

However, strong bullish sentiment faded after heavy exchange of fire between two countries over the weekend did not damage any significant oil installation, prompting market participants to change direction on fact that there were no immediate threats on oil supply.

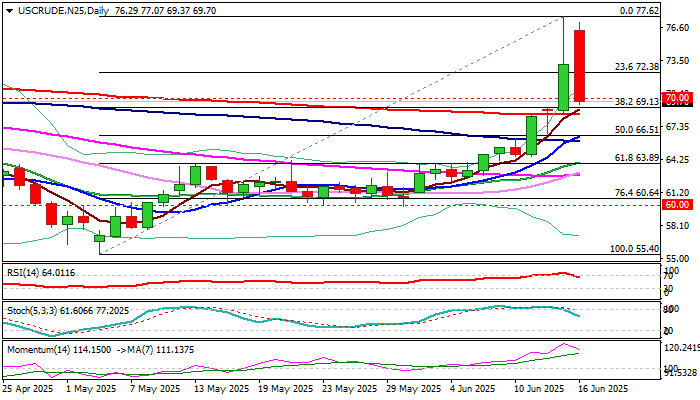

Technical picture on daily chart shows bullish momentum weakening and stochastic reversing just under the border of overbought zone but remains overall bullish for now.

The pullback that came after strong upside rejection on Friday, broke below Fibo 23.6% of $55.40/$77.62 upleg ($72.38), and cracked the first of three pivotal supports ($70.00/$69.13/$68.49 – psychological / Fibo 38.2% / 200DMA).

Firm break of this zone would weaken near-term structure and open way for deeper correction.

On the other hand, geopolitical situation, as key oil driver nowadays, remains overheated, with fears that closure of Strait Hormuz by Iran could strongly inflate oil prices.

Res: 71.42; 72.02; 72.79; 74.36

Sup: 69.13; 68.45; 66.50; 65.99