Oil prices drop on oversupply concerns as US and Iran are close to reach a deal and US crude stocks rise

WTI oil price fell over 3% on Thursday morning, as positive sentiment was soured by the latest encouraging news about US-Iran nuclear talks which may result in easing of sanctions on Iranian oil export and unexpected strong build in US crude stocks that added to growing concerns about oversupply.

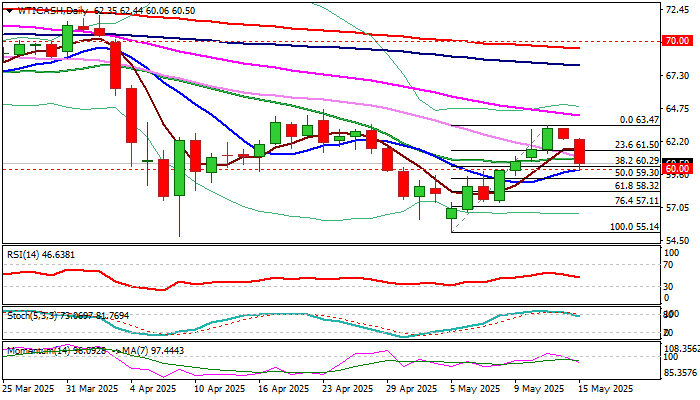

Thursday’s strong acceleration extends pullback from recovery top ($63.47) after repeated failure at important Fibo barrier at $63.38 (50% of $71.98/$54.77) and just under the base of falling daily cloud.

Fresh weakness cracked strong supports at $60.29/00 zone (Fibo 38.2% of $55.14/$63.47 recovery leg / psychological, reinforced by 10DMA).

Clear break here to generate fresh bearish signal for deeper drop.

The notion is supported by strengthening negative momentum and stochastic emerging from overbought zone, however bears may face increased headwinds due to significance of supports.

Consolidation above $60 zone may precede fresh push lower, but caution on bounce above $61.50 (broken Fibo 23.6%) which may sideline bears and generate initial signal of an end of corrective phase.

News about progress in US-Iran talks will be closely watched for further direction signals.

Res: 61.00; 61.50; 62.44; 63.00

Sup: 60.00; 59.30; 59.00; 58.32