Oil prices extend weakness as surge of Omicron cases warns of new restrictions

WTI oil opened with a gap and below $70 level on Monday and fell over 4% in Asia and early Europe, extending last Friday’s drop, pressured by rising concerns over global fuel demand, as surging cases of Omicron variant in the Europe and the United States threaten of new restrictive measures to combat spread of virus.

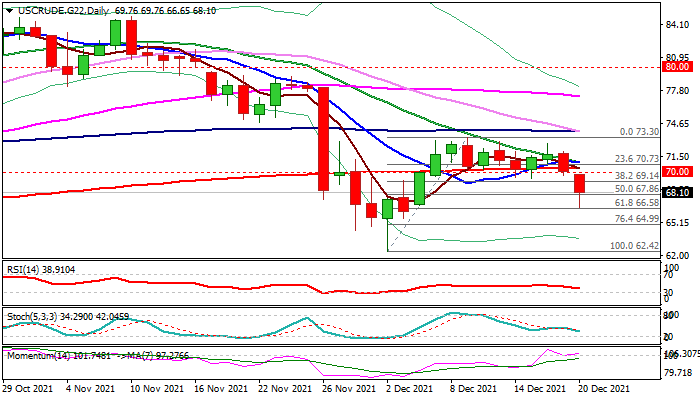

Fresh weakness eventually broke below the floor of nine-day congestion at $70 zone (after recovery from Dec 2 low at 62.42 lost traction), retracing so far almost 61.8% of $62.42/$73.30 upleg and signaling that corrective phase might be over.

Today’s close below $70 level (now reverted to solid resistance) would confirm initial negative signal and keep fresh bears in play for renewed attack at $66.58 pivot (Fibo 61.8% of $62.42/$73.30), break of which to confirm reversal and increase risk of retest of $62.42 low.

Res: 69.14; 70.00; 70.41; 70.73

Sup: 67.86; 66.58; 64.99; 64.42