Platinum eases from new multi-month high as traders take profit from nearly 30% rally in June

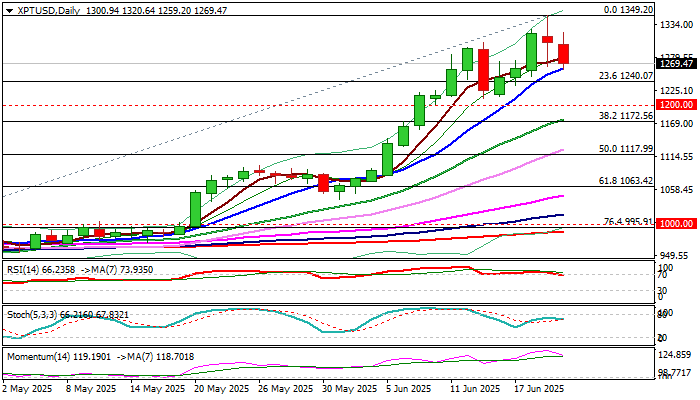

Platinum extends pullback into second consecutive day and fresh bears accelerated on Friday on stronger profit taking from new multi-year peak ($1349 – the highest since Sep 2014).

The metal was in steep rally in past two months, which gained pace in June, when the price advanced almost 30% in first three weeks of the month.

Strong acceleration was sparked by breach of psychological $1000 level in early May and boosted by growing demand and unchanged supply that created a disbalance and lifted the price sharply.

Profit-taking after such strong rally could be also significant, as pullback was signaled by bearish divergence on RSI and Stochastic indicators before the price started to ease, as well as strong reaction to steep advance in past two months.

Easing geopolitical situation is also likely to contribute to near-term action.

Reversal pattern is about to be completed on daily chart that would contribute to bearish outlook.

Bears cracked initial support at $1260 (rising 10DMA), guarding Fibo support at $1240 (23.6% retracement of $886/#1349 uptrend), violation of which to expose psychological $1200 level and Fibo 38.2% at $1172.

Res: 1300; 1320; 1327; 1349

Sup: 1260; 1240; 1200; 1172