Sentiment sours on weak bank earnings

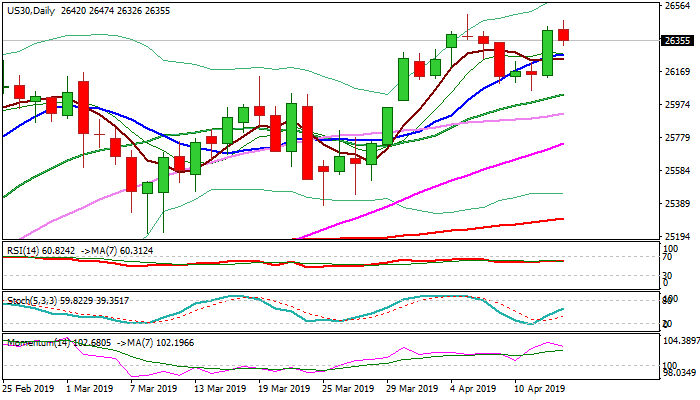

The Dow Jones eases from marginally higher one-week high at 26474 on Monday, as mixed bank earnings soured the sentiment.

Signals that earnings season will disappoint came from weaker than expected earnings results for Goldman Sachs, Citi and Bank of America.

Dow lost traction after last Friday’s 1.02% advance on approach to 2019 high at 26506 (the highest since early Oct 2018).

Deeper pullback can be expected as bullish sentiment fades and sentiment weakens after earnings data.

Fresh bears eye initial support at 26271 (10SMA), violation of which would expose higher low at 26059 (11 Apr) reinforced by rising 20SMA, where dips should be ideally contained to keep bulls intact.

Overall structure is bullish and underpinned by rising thick daily cloud (top of cloud lays at 25619) and marks key support, loss of which would point to deeper correction.

Res: 26474; 26506; 26817; 26962

Sup: 26326; 26272; 26138; 26059