Silver hits new record high above $60, strongly underpinned by industrial and safe-haven demand

Silver hit new record high ($61.59) on Wednesday, in extension of Tuesday’s strong acceleration higher which resulted in a daily gain of 4.5% and break through psychological $60 barrier.

Silver continues to benefit from strong demand for safe haven, as well as an evident disbalance between industrial demand and supply.

Silver’s sharp rise in past six months was steeper than advance of gold that continued to push gold – silver ratio lower (in June, one ounce of gold was buying around a hundred ounces of silver, while today only 69 ounces of silver were needed to buy an ounce of yellow metal.

Today’s slight easing from new all-time high could be seen rather as positioning for further advance than as stronger pullback, as markets widely expect 25 basis rate cut by Fed and many anticipate that the US policymakers may adopt more dovish stance on rates in coming months (due to significant weakening in the labor sector and also that further easing in monetary policy is President Trump’s preferred scenario).

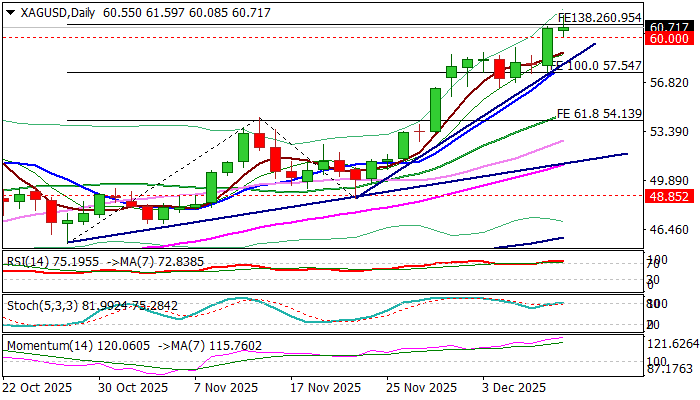

Broken $60 level now reverted to solid support which so far holds today’s action, with potential deeper dips to find firm ground above $58 (rising 10DMA) to keep bulls intact.

The price currently rides on the third wave of five-wave cycle from $45.53 (Oct 28 low) and probed through 138.2% Fibonacci expansion ($60.95).

Bulls eye targets at $62 (psychological) and $63.05 (Fibo 161.8% expansion).

Res: 61.59; 62.00; 63.05; 64.00

Sup: 60.00; 58.98; 58.00; 57.54