Silver surges through $40 and hits the highest since 2011

Silver accelerated higher at the start of the week (up over 2% in Asia / early Europe on Monday) and broke above psychological $40 barrier for the first time in over a decade.

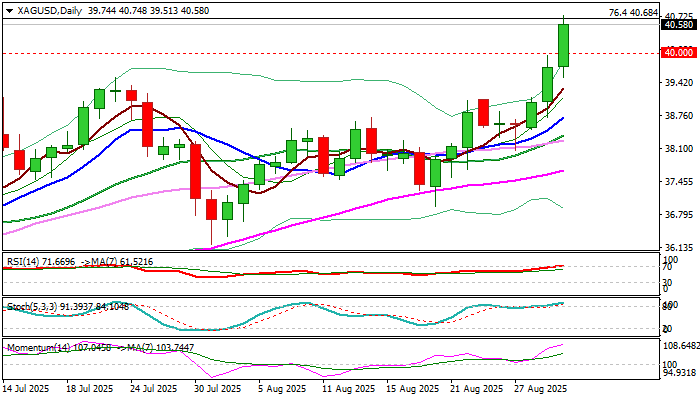

Fresh gains hit the highest since April 2011 and cracked Fibo barrier at $40.68 (76.4% of larger $49.78/$11.23 downtrend, 2011/2020), in extension of steep upleg from $38.07 (Aug 27 higher low).

Silver received fresh boost from growing expectations of Fed rate cut in September, showing stronger reaction to the latest news than gold, with tight supply also contributing to the rally.

Daily close above $40 is needed to confirm strong bullish stance, though bulls started to face headwinds at $40.68 Fibo barrier, due to overbought daily studies.

In current environment, dips should be limited and mark positioning for fresh advance, with broken $40 level reverting to solid support, along with former multi-year top at $39.52, where dips should find firm ground.

Sustained break of $40 barrier and Fibo level at $40.68, to generate strong bullish signal and unmask targets at $43.38/$44.18 (highs of Sep / Aug 2011 respectively).

Res: 40.74; 41.00; 41.57; 42.00

Sup: 40.00; 39.52; 39.09; 38.72