SILVER surges to new 13-year high

Silver price surged on Thursday, rallying nearly 4% by the mid-European trading, to hit the highest since February 2012.

Fresh demand also lifted the silver price to new record high in India, that contributes to strengthening bullish outlook, as silver enjoys strong support from ongoing geopolitical tensions and growing signals of slowdown in US economic growth.

Uncertainty over tariffs is another supportive factor for precious metals that adds them to the assets used to counter threats of stronger negative impact from weakening economic growth, shockwaves from heated geopolitical situation and higher inflation.

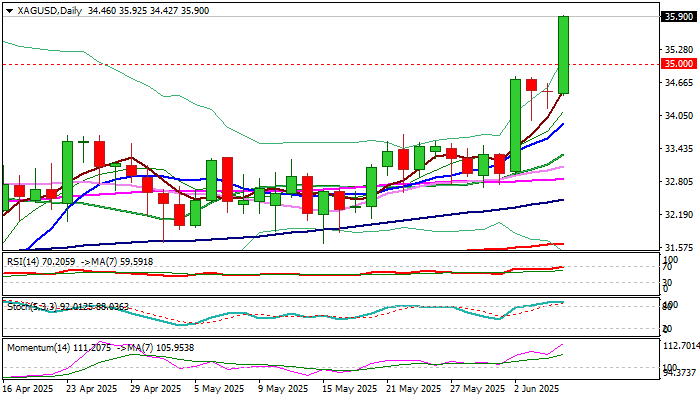

Silver price breached barriers at $34.78 and $35.00 (former top / psychological) and pressure immediate targets at $36.00 and 36.10 (round-figure / Fibo 123.6% projection of the rally from $28.15, 2025 low), violation of which would unmask $37.04 (Fibo 138.4% projection).

Daily studies are fully bullish but overbought and suggest that bulls may take a breather for consolidation in the coming sessions.

Broken $35.00 level (psychological / broken Fibo 61.8% of larger $48.78/$11.23 downtrend) reverted to support which should keep the downside protected.

Res: 36.00; 36.10; 37.04; 37.48

Sup: 35.00; 34.78; 33.90; 33.66