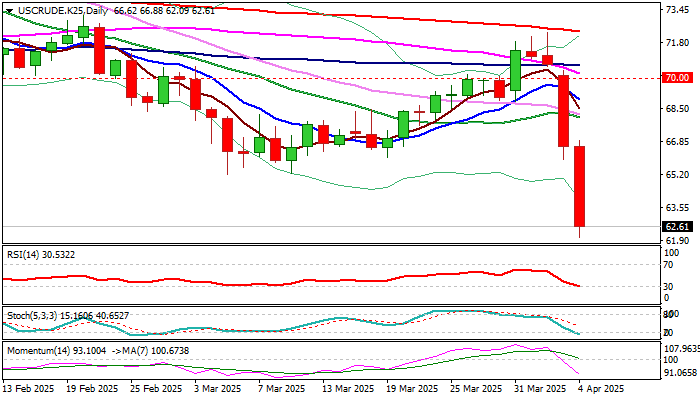

WTI Oil – bears hold grip after a massive losses in past two days

WTI oil price remains in a steep fall for the second straight day and hits the lowest levels since December 2021 on Friday, after US tariffs rattled global markets and soured sentiment.

Unexpected decision of OPEC+ group to increase production above consensus from May, added to strong bearish outlook.

Oil prices fell around 11% in less than two days, on track for the worst week since the first week of October 2023.

Key longer-term supports at $62.42/$61.79 (lows of Dec/Aug 2021 that formed a higher base on monthly chart) are under increased pressure.

Firm break of these levels to signal further weakness with immediate target at $60.00 (psychological), loss of which to expose $53.87 (Fibo 61.8% of $6.52/$130.48 uptrend).

Bears show so far limited signs of fatigue despite recent massive losses, however oversold daily studies and Friday’s profit taking may keep bears on hold for some time.

According to current situation, upticks are likely to be limited and offer better levels to re-enter firmly bearish market.

Former base at $65.22/25 (Mar 5/11) act as resistance which should limit recovery action.

Res: 63.00; 64.49; 65.22; 65.98

Sup: 62.00; 61.70; 60.86; 60.00