WTI Oil – bears hold grip as trade issues continue to sour the sentiment

WTI oil price remains in red for the fourth consecutive day and trading near new three-week low on Wednesday.

Bears hold grip despite a partial relief from announcement of US trade deal with Japan, as dissonant tone come from the EU (the bloc did not reach a deal yet but considering countermeasures on US tariffs) and China, that continues to sour the sentiment.

Markets also focus on the signals of impact from the latest package of EU sanctions on Russia, which mainly target Russian oil industry, as well comments that the US would consider sanctioning Russian oil that are assumed as supportive factors.

Increased supply after Azerbaijan oil exports resumed today after being paused for a couple of days, contribute to existing pressure on oil prices.

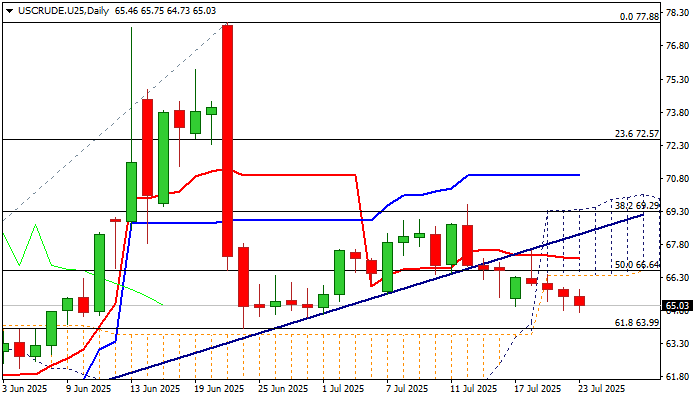

Technical picture weakened after the price broke below ascending and thickening daily Ichimoku cloud, while daily Tenkan / Kijun-sen remain in bearish configuration.

Bears attack again 100DMA ($64.93) after faced several rejection at the indicator, with firm break here to expose next significant support at $63.99 (Fibo 61.8% retracement of $55.70/$77.88 rally).

Daily cloud base ($66.37) marks solid resistance which should ideally cap potential upticks.

Res: 65.80; 66.37; 67.18; 68.28

Sup: 64.50; 63.99; 63.05; 62.18