WTI OIL – bears may take a breather to position for fresh push lower

WTI oil price fell further on Friday, remaining on track for the third consecutive weekly loss and the second straight weekly close below $60 mark.

Oil remains under pressure from darkened demand outlook, with the latest forecast from International Energy Agency about growing supply surplus, news about potential meeting between US and Russian Presidents, and growing US-China trade tensions, contributing to current picture.

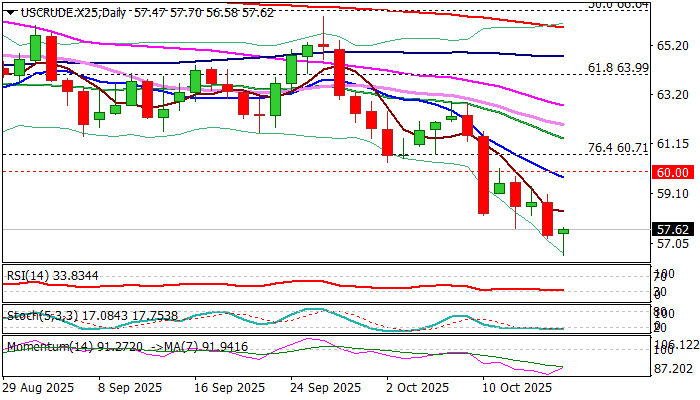

Oil price fell to the lowest in five months and eyes key supports at $55.40/12 (2025 lows posted in Apr/May) which also formed a double bottom, ahead of subsequent strong rally.

Daily studies are in full bearish setup, but oversold conditions,14-d momentum indicator turning north from the depth of negative territory and anticipated profit taking at the end of the week, suggest that we may see some consolidation or limited correction.

Broken $60 level reverted to initial resistance (reinforced by falling 10DMA), followed by broken Fibo 76.4% ($60.71) and $61.50 zone (former range floor and higher base, reinforced by 20DMA), where stronger upticks should be capped to keep larger bears in play.

Res: 58.37; 59.74; 60.00; 60.71

Sup: 56.58; 55.40; 55.12; 53.87