WTI Oil – bears regain control on demand concerns, reaction at key $60 support in focus

WTI oil price remains in red for the second consecutive, weighed by fresh demand concerns following weak manufacturing numbers and OPEC+ decision to pause oil production hikes in early 2026, with strong dollar also contributing to near-term performance.

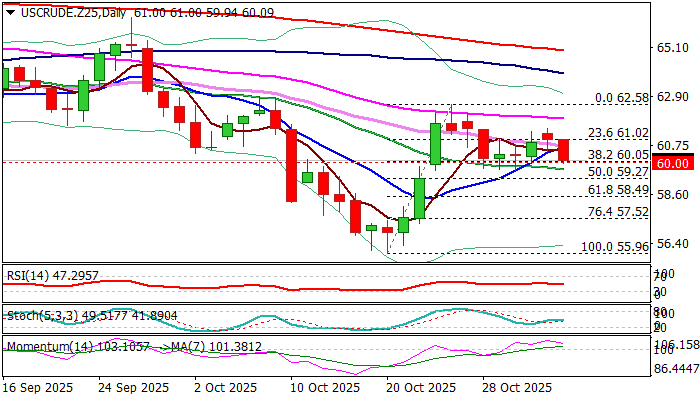

The price fell nearly 1.5% in early Tuesday trading and attacks again significant $60 support (psychological / Fibo 38.2% of $55.96/$62.58 recovery leg) where several attacks failed recently.

Daily studies lack clearer direction signal (MAs in mixed setup, but daily Tenkan/Kijun-sen have formed bull-cross / fading positive momentum), with reaction at $60 level seen as key for the near-term action.

Firm break lower to generate initial signal that corrective leg from $55.96 (Oct 20 multi-month low) might be coming to its end and shift focus to the downside (targets at $59.27 and $58.49, Fibo 50% and 61.8% respectively).

Conversely, repeated failure at $60 support would add to significance of support and keep the price in extended range, with initial bullish signal expected on break of range top ($61.48).

Res: 60.42; 61.00; 61.95; 62.58

Sup: 59.70; 59.27; 59.00; 58.49