WTI oil – bulls may take a breather for consolidation on overbought daily conditions

WTI oil kept firm tone and rose to new multi-week high on Monday, in extension of Friday’s 2.5% advance.

Prevailing positive sentiment on growing hopes for a deal in US-China trade talks and subsequent rise in oil demand continues to inflate oil prices.

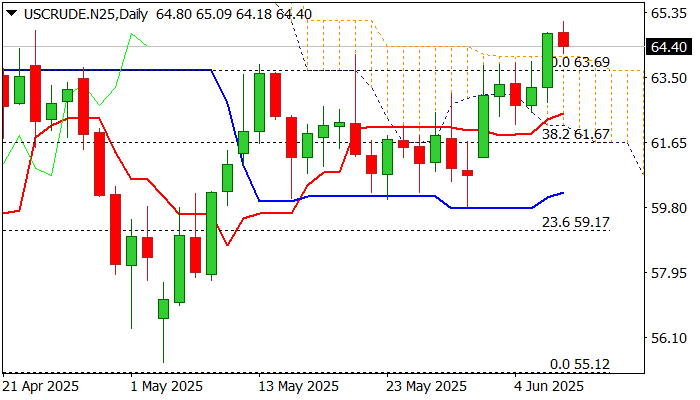

The contract was up 5.7% last week, with Friday’s close above significant technical barriers at $63.69/64.12 (50% retracement of $72.27/$55.12 / daily cloud c top), generating fresh bullish signals.

Predominantly bullish daily studies contribute to positive near term outlook, but overbought conditions warning that bulls may pause for consolidation before accelerating again.

Immediate target lays at $65.00 (psychological), followed by $65.72 (Fibo 61.8%), with cloud top (currently at $63.69) to ideally contain dips and keep near term bias with bulls.

Caution on dip and close within daily cloud, with stronger bearish signal to be expected on break of daily Tenkan-sen ($62.47).

Res: 65.09; 65.72; 66.00; 66.43

Sup: 63.69; 62.80; 62.47; 62.00