WTI OIL – bulls pause under cloud top after strong advance in past two days

WTI oil price eases from new five-week high on Wednesday after advancing over 6% in past two days.

Partial profit taking after strong rally was caused by technical signals, as well as on uncertainty over President Trump’s latest threats of imposing a secondary tariffs of 100% to all those importing oil from Russia.

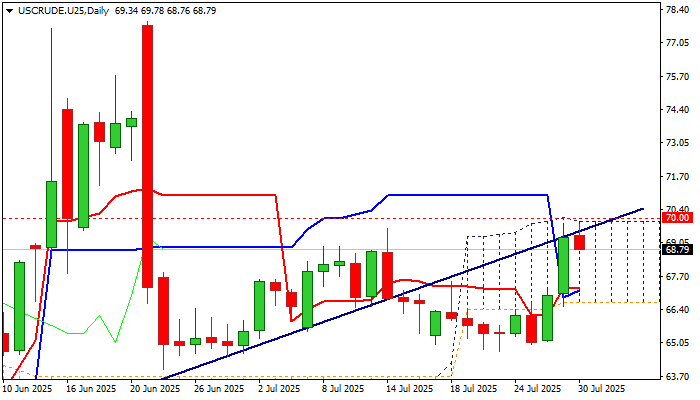

The latest rally was repeatedly capped under the top of thick daily cloud as the price penetrated cloud on Monday and rose near its top on Tuesday, generating strong bullish signal.

Daily studies improved (Tenkan/Kijun-sen bull-cross / 14-d momentum broke into positive territory) but overbought stochastic and sideways-moving RSI suggest that bulls are like to take a breather and look for fresh signal.

Dips should find solid supports at $67.96/85 (broken 200DMA / Fibo 38.2% of $64.72/$69.78 upleg) to mark a healthy correction ahead of fresh attack at cloud top and nearby psychological $70 barrier, violation of which to signal bullish continuation.

Otherwise, deeper pullback would keep bulls on hold, but with limited downside risk as long as the price stays above daily Tenkan-sen / 50% retracement of ($67.25).

Return below cloud base ($66.65) will be bearish.

Unexpected rise in US crude stocks (API report showed 1.53M build vs 2.5M draw forecast) contributed to weaker tone today, with release of EIA crude inventories report (-2.3M fc vs -3.16M previous) being in focus today.

Res: 69.62; 70.00; 70.92; 71.33

Sup: 68.59; 67.96; 67.25; 66.65