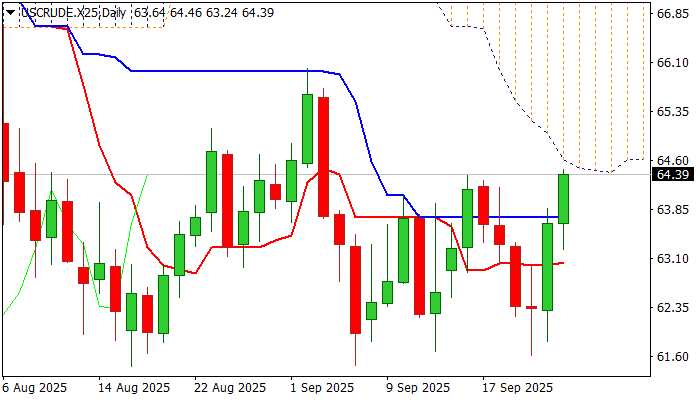

WTI OIL – fresh acceleration higher faces strong resistance from the base of thick daily cloud

WTI oil price rises for the second straight day, underpinned by renewed supply concerns and drop in US weekly crude inventories (API report on Tuesday -3.82 mln bls vs 3.64 mln bls previous week).

Oil advanced over 3% in past two days, following formation of Morning Doji Star reversal pattern on daily chart.

Bulls cracked important barriers at $64.27/37 (Fibo 61.8% of $66.01/$61.46 / Sep 16 recovery peak) but may face increased headwinds from nearby base of very thick daily Ichimoku cloud ($64.62). Technical picture on daily chart is mixed as positive momentum studies are countered by formation of 55/100DMA bear cross and pressure from daily cloud.

Two scenarios are currently in play, the fist one sees failure to close above recent range top ($64.37) that will keep the price within the range, although with slight bullish alignment as long as the price holds above $63.40 zone.

This scenario looks favored for now as daily cloud weighs on price and may temporarily sideline bulls.

The second scenario includes break of range top and penetration of daily cloud, which would generate positive signals of break above the range, recovery continuation and formation of higher base at $61.50 zone.

Res: 64.62; 64.94; 65.10; 66.01

Sup: 63.73; 63.40; 63.00; 62.53