WTI oil hits new multi-week high on growing optimism about US-China trade talks

Growing optimism about a trade deal between the US and China that would ease tensions, boost economic growth and consequently boost demand, continues to lift oil prices.

WTI contract rose to the highest in over two months on Tuesday, extending the latest bull-leg into fourth straight day.

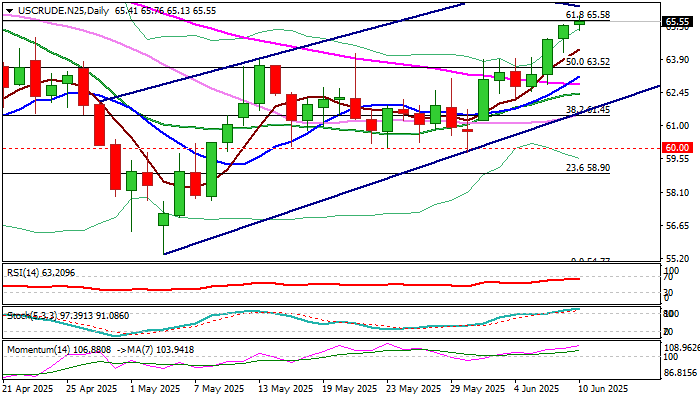

Fresh advance cracked important Fibo barrier at $65.58 (61.8% retracement of $72.27/$54.77 fall), after generating bullish signals on break above daily cloud and former recovery top of Apr 23 ($64.85).

Bulls hold grip and eye next target at $66.20 (100DMA), but strongly overbought stochastic (although still not showing signs of fatigue) generates initial warning that bulls may soon run out of steam.

Consolidation or shallow dips should be likely scenario in current situation when positive comments about the outcome of trade talks boost expectations for a good deal between two largest world economies and top oil consumers.

Extended dips should stay above daily cloud top ($64.12) to keep bulls intact for further advance.

Res: 65.76; 66.20; 66.88; 67.66

Sup: 65.13; 64.85; 64.12; 63.52