WTI oil – near-term bulls hold grip, on track for strong weekly advance

WTI oil keeps firm tone on Friday, underpinned by supply concerns on output shortages from Iraq and US stockpiles hitting the lowest in two years, while US data showed cooling price growth and stress on banks continues to ease.

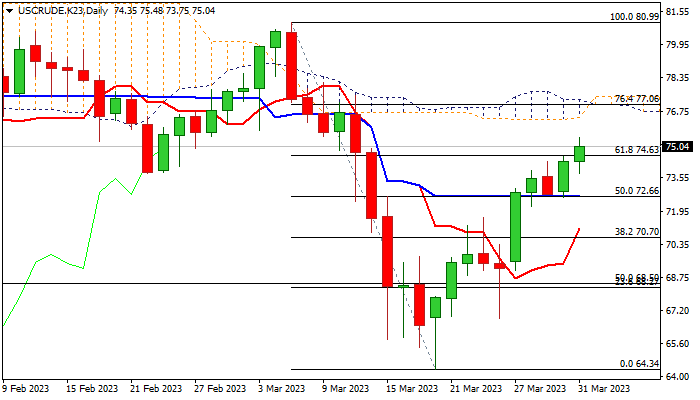

Fresh upside extension hit three-week high ($75.48), following break of pivotal Fibo resistance at $74.63 (61.8% of $80.99/$64.34 fall).

Bulls are on track for the second straight weekly advance (over 8%), but will end month in red, in the worst performance since November.

Improving picture on daily chart (14-d momentum is breaking into positive territory / 10/20/30 DMA’s turned to bullish setup) is countered by overbought stochastic and still prevailing bearish tone on weekly chart, which needs further work at the upside.

Daily close above broken Fibo barrier ($74.63) to verify bullish signal and keep focus at next target at $77.06 (100DMA / Fibo76.4%), which guard key barriers at $80.00/99 (psychological / Mar7 high).

Pivotal support at $72.66 (daily Kijun-sen / broken 50% of $80.99/$64.34) needs to hold potential dips to keep bulls in play.

Res: 75.48; 76.44; 77.06; 78.14

Sup: 74.63; 73.75; 72.66; 71.15