WTI oil – near term sentiment cooled after gap-higher opening and spike to new multi-month high, but larger bulls hold grip

WTI oil eased quickly from new six-month high ($77.88, hit after Monday’s gap-higher opening), signaling that traders are not very much concerned about growing threats of strong supply disruptions, though overall picture remains firmly bullish.

The oil opened around 5% higher on Monday, after the US attacked Iran during the weekend, in action that was strongly criticized by a number of countries, including two superpowers, China and Russia.

The timing of attack was important, as Israel started the conflict by launching attacks on Iran last Friday that prevented panic market reaction (as the markets were closed) and leaving enough time for traders to digest news before taking the action.

This comes after Trump’s tariff announcement (Liberation Day) which was announced on a weekday and caused a big damage, particularly to stock markets.

Although markets were worried of escalation of the conflict and anticipated that Iran’s immediate response will be closure of Hormuz strait that would cause significant disruption in oil supply and probably send the price towards $100 per barrel, this was not the case so far.

Markets will be closely watching the developments in Iran – US/Israel conflict and look for fresh signals as Iranian parliament has already voted for closure of Hormuz (awaiting verification), with focus on reaction from Russia (Iranian foreign minister is meeting President Putin today), as well comments from the UN Security Council which meets today on request of Iran.

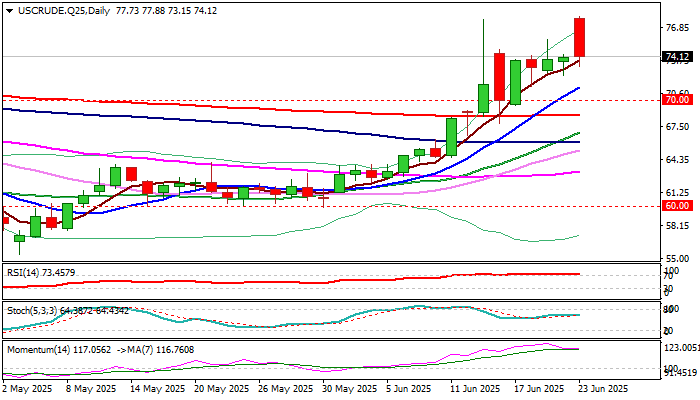

Technical picture on daily chart remains bullish despite overnight’s drop in the price that caused weakening of positive momentum, as technical indicators are in bullish configuration and continue to underpin.

Solid supports at $72.50 zone (Fibo 23.6% of $55.40/$77.88 / higher base) should contain dips and keep firmly bullish near term structure intact for fresh attempts higher.

Rising 10DMA ($71.19) marks next support and guards lower breakpoints at $70.00/$69.29 (psychological / Fibo 38.2%) loss of which would sideline bulls.

Res: 77.88; 78.45; 79.35; 80.00;

Sup: 73.15; 72.57; 72.34; 71.19