WTI oil on track for the biggest weekly loss in months but oversold studies may slow bears

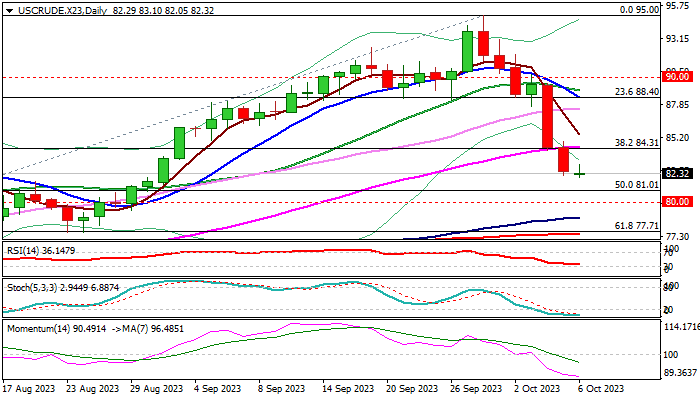

WTI oil remains at the back foot and holding at the lowest in five weeks on Friday, following a strong fall in past two days (down 7.6%).

Renewed concerns about further slowdown in global economic growth on keeping high interest rates for longer period, which would result in a more negative impact on oil demand, increased pressure on oil prices.

In addition, Russia had lifted its ban on diesel exports, imposed on Sep 21, which contributes to negative near-term outlook.

The WTI is on track for the biggest weekly loss since mid-March (over 9%), with massive bearish candle on weekly chart, signaling formation of reversal pattern.

Bears closed below pivotal Fibo support at $84.31 (38.2% of $67.02/$95.00) with weekly close below here to confirm bearish signal.

Daily studies weakened significantly, however, overstretched 14-d momentum and deeply oversold stochastic, might be an obstacle for bears, in addition to the headwinds provided by rising daily Ichimoku cloud, as the recent weakness approached cloud top ($81.79).

Limited consolidation should be ideally capped under $84.31/50 (broken Fibo 38.2% / 55DMA) to keep bears intact and offer better selling opportunities, for acceleration towards psychological $80 support.

Res: 83.10; 84.50; 84.87; 85.00

Sup: 82.05; 81.01; 80.00; 78.81