WTI oil – recovery faces strong headwinds at key Fibo barrier

WTI oil edged higher on Thursday and recovered part of losses of previous day (down 2.4% for the day) after OPEC signaled further output increase from June.

Limited recovery remains weighed by signals of further supply increase and with still unclear situation with tariffs, after calmer tones were heard from the US President yesterday.

Overall picture is also clouded by weak global economy (IMF in its latest report downgraded outlook) with further output increase to add to negative factors.

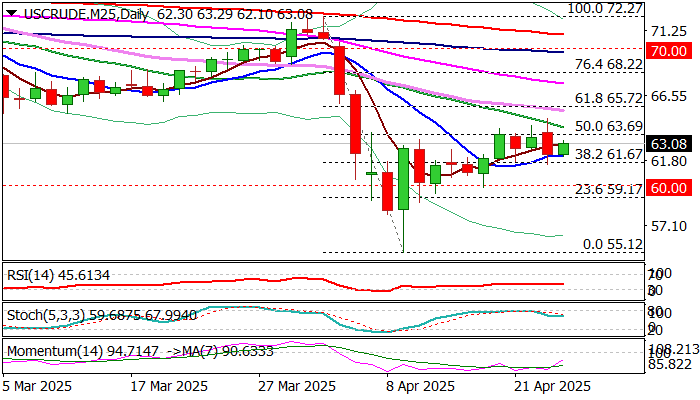

Near-term price action shows that recovery from 4-year low ($55.12) faces strong headwinds at significant Fibo barrier at $63.69 (50% retracement of $72.27/$55.12 bear-leg), reinforced by daily Kijun-sen), with four consecutive rejections at this zone, indicating possible stall.

Daily studies are predominantly negative and support this scenario, however breach of boundaries of recent range which extends into fifth day (Fibo 38.2% at $61.67 and 50% at 63.69) will be required to define near term direction.

Res: 63.69; 64.21; 64.85; 65.22

Sup: 62.14; 61.67; 60.00; 59.17