WTI oil resumes larger downtrend

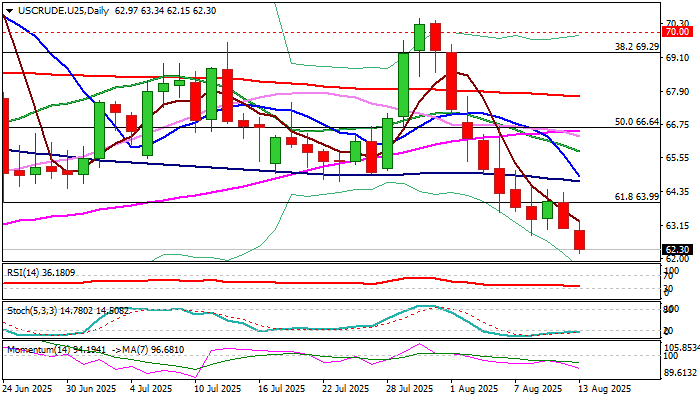

WTI oil remains firmly in red and fell to nine-week low on Wednesday, signaling continuation of larger downtrend which paused for a brief consolidation in past three days.

The recent decision of OPEC + cartel to further increase output was one of key oil drivers, along with International Energy Agency’s latest report that showed expectations for stronger supply growth in 2025, as well as lowered demand forecast, due to still fragile economic growth in most of major economies.

Dissonant tones that came from US Treasury Secretary’s threat of imposing sanctions on Russia and secondary tariffs on countries buying Russian oil, if talks between President Trump and President Putin fail, did not impact current market situation and kept bears firmly in play.

Daily studies are in full bearish configuration, with strengthening negative momentum and multiple bear-crosses, maintaining pressure, however, oversold Stochastic with bearish divergence, warns that bears may take a breather before resuming towards targets at $60.71 (Fibo 76.4%) and $60.00 (psychological).

Upticks should be ideally capped by $64.00 zone (broken Fibo 61.8%).

Res: 63.34; 64.00; 64.70; 65.00

Sup: 62.00; 61.24; 60.71; 60.00