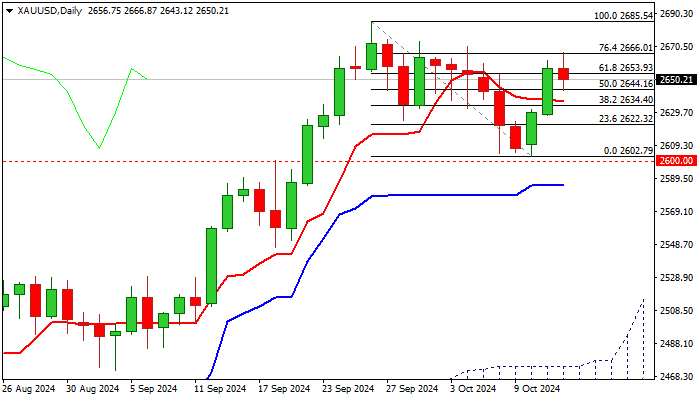

XAUUSD – bulls to remain in play above $2600

Gold price rose to the highest since Oct 4 on Monday, in extension of strong rally last Thu/Fri, inflated by the latest decision by China to further boost its stimulus to the economy.

The news sparked fresh risk aversion by signal that Chinese economic growth is stalling, giving fresh boost to safe-haven demand however, technical picture is not so encouraging.

Daily studies are mixed as MA’s turned to bullish setup, but 14-d momentum is heading south and cracking the centreline.

Double-Doji on weekly chart adds to signals of indecision (although long tails and dips contained by psychological $2600 support suggest that bids are still strong), along with overbought stochastic and fading bullish momentum, while WMA’s remain in bullish configuration.

Market focus will remain on Fed, as investors expect more details about the central bank’s next steps on monetary policy, which will be likely one of key drivers of the yellow metal.

Larger bulls are expected to remain fully in play if current consolidation under new all-time high stays above $2600 support.

Near-term action faces solid support at $2636 (daily Tenkan-sen), holding above which to keep immediate bias with bulls and guard $2600 support.

Res: 2666; 2673; 2685; 2700

Sup: 2643; 2636; 2622; 2602