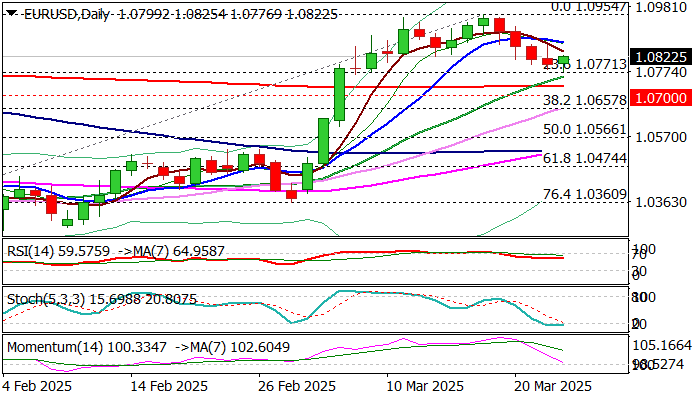

EURUSD – recovery attempts above Fibo support / 20DMA

EURUSD ticked higher on Tuesday after four-day pullback from new multi-month high at 1.0954 (larger rally stalled just under Fibo resistance at 1.0969) found temporary footstep at 1.0771 (Fibo 23.6% of 1.0177/1.0954 rally).

Partial profit taking lifts the price, although bounce was not significant so far as the action remains negatively impacted by recent strong loss of positive momentum.

South-heading 14-d momentum indicator is in step descend and approaching the centreline but partially offset by the latest 20/200DMA golden cross formation (1.0727).

Recovery needs to clear 1.0860 zone (Monday’s high / 10DMA) to signal reversal and a higher low.

Fibo level at 1.0771, reinforced by rising 20DMA and nearby 200DMA (1.0729 mark solid supports, with near-term bias to remain with bulls while the price stays above these levels.

Conversely, firm break lower would open way for deeper correction.

Tariff talks remain one of key fundamental points, with today’s release of US Consumer Confidence to also contribute, as markets await release of US PCE data on Friday, Fed’s preferred inflation gauge, which will provide more details about the central bank’s near future steps on monetary policy.

Res: 1.0860; 1.0888; 1.0954; 1.0969

Sup: 1.0771; 1.0760; 1.0729; 1.0700