WTI oil rises and on growing threats about new tariffs and potential military confrontation with Iran

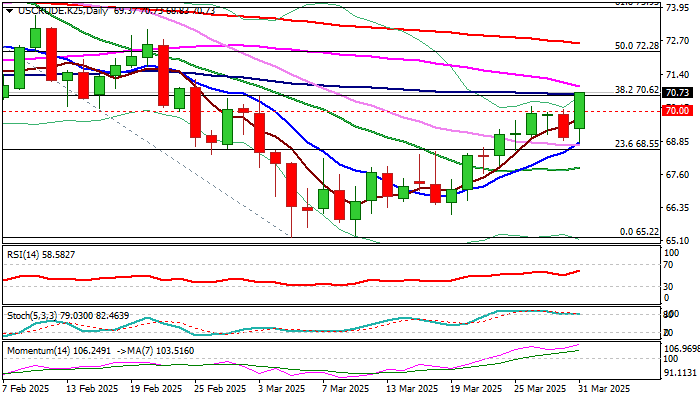

WTI oil price firmed on Monday and broke through psychological $70 barrier, where bulls were repeatedly capped last week.

The price action moved within narrow consolidation in past few days, signaling that larger bulls remain firmly in play for final break higher.

Mild initial market reaction on latest threats from President Trump about imposing secondary tariffs on buyers of Russian oil signaled that traders need more evidence of such action and also remained in wait and see mode over the US threats of military attack on Iran.

However, the sentiment remains firmly bullish, as the latest acceleration contributes to scenario of firm break of $70.00 and $70.62 (Fibo 38.2% of $79.35/$65.22 / 100DMA), to generate signal of continuation of bull-leg from $65.22 (2025 low, posted on Mar 5).

Daily studies are still mixed, but bullishly aligned that fuels hopes of stronger upside acceleration (on sustained break above $70.00/62 pivots) as fundamentals are becoming more favorable, although the news on Russia and Iran still need a confirmation.

Firm break of $70.62 to unmask targets at $72.28 (50% retracement) and $72.60 (200DMA), with close above $70 required to keep fresh bulls in play.

Res: 70.98; 71.24; 72.00; 72.28

Sup: 70.20; 70.00; 69.05; 68.55