Dax accelerates lower on trade war escalation

Dax accelerated sharply lower on Friday after China announced its 34% tariffs on US goods, worsening further near term outlook.

The index was down nearly 5% on Friday and on track for a weekly loss of 7.5%, the biggest in more than a decade.

Fundamental conditions are unlike to improve soon but could deteriorate and fuel expectations for further losses.

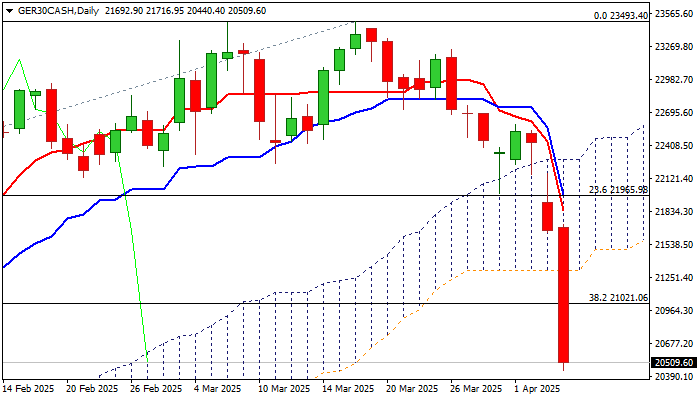

Reversal pattern has been completed and double top left on daily chart, with formation of multiple bear crosses (10/20/30DMA’s) with converging 10/55DMA’s about to form another bear cross.

Weekly close below broken Fibo support at 21021 (38.2% of 17021/23493 uptrend) to contribute to negative signals.

Bears approach next trigger at 20257 (50% retracement) violation of which to expose 20000 zone (psychological / 200DMA).

Extended upticks should stay under broken base of thick daily Ichimoku cloud (21309).