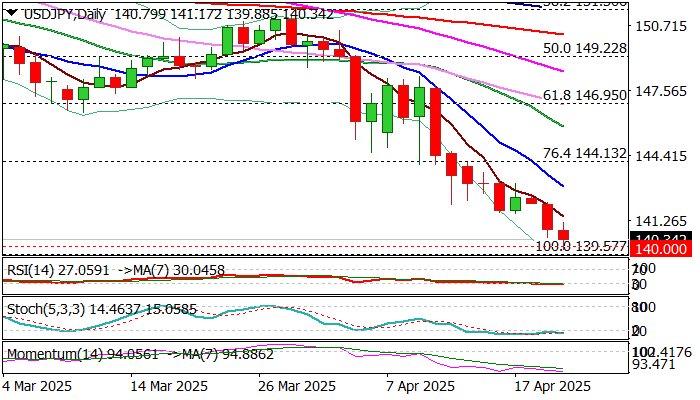

USDJPY – bears likely to pause above key support zone at 140.00/139.57

USDJPY edged higher on Tuesday after bears cracked psychological 140 support and hit new multi-month low (139.88) and approached key med-term support at 139.57 (2024 low posted on Sep 16).

Partial profit taking at this zone was quite logical action which provides a breather to larger bears, to consolidate and position for final attack at 139.57 pivot.

Oversold daily studies contribute to such scenario, although upticks are likely to be limited as technical picture is very bearish and current situation is very fragile that is expected to continue to fuel risk aversion to support safe-haven yen further deflate US dollar.

Bounce was so far mild, with stronger upticks to be ideally capped under falling daily Tenkan-sen (143.84) to keep larger bears fully in play.

Clear break of 140.00 and 139.57 pivots to signal continuation of 2025 downtrend (from 158.87, Jan peak) and expose targets at 137.23 (July 2023 trough) and 135.41 (Fibo 76.4% of 127.22/161.95) in extension.

Res: 141.17; 142.12; 142.91; 143.84

Sup: 140.00; 139.57; 137.23; 135.41