USDJPY inflated by fresh risk appetite but still lacks clearer direction signal

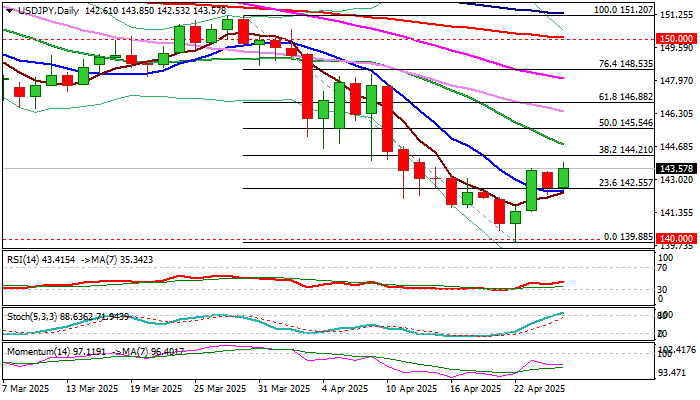

USDJPY remains constructive as bounce from multi-month low (139.88) holds above broken Fibo level at 142.55 (23.6% of 151.20/139.88 bear-leg, reinforced by 10DMA) for the third consecutive day.

Safe haven yen benefited from the recent uncertainty over US trade tariffs and anticipated negative impact on global economy, advancing over 10% from its January low vs US dollar, but the latest calmer tones that come from two biggest world’s economies (USA and China) faded safe haven demand that could further pressure yen if situation continues to improve

Friday’s fresh gains fully reversed Thursday’s drop, keeping in play hopes for attack at pivotal Fibo barrier at 144.21 (38.2% retracement) break of which to strengthen the structure and open way for stronger recovery.

However, predominantly negative daily studies (bearish momentum is still strong and stochastic is overbought) warn of possible recovery stall.

Look for reaction on key levels (142.55 or 144.21) which would provide clearer direction signals.

Res: 143.85; 144.21; 144.78; 145.54

Sup: 142.55; 141.65; 141.41; 140.47