Gold – loss of pivotal $3300 support zone generates reversal signal

Gold dropped 1.6% in holiday-thinned Asian trading on Thursday, hitting the lowest in two weeks, as fresh risk appetite on fading trade tensions further dented metal’s safe-haven appeal.

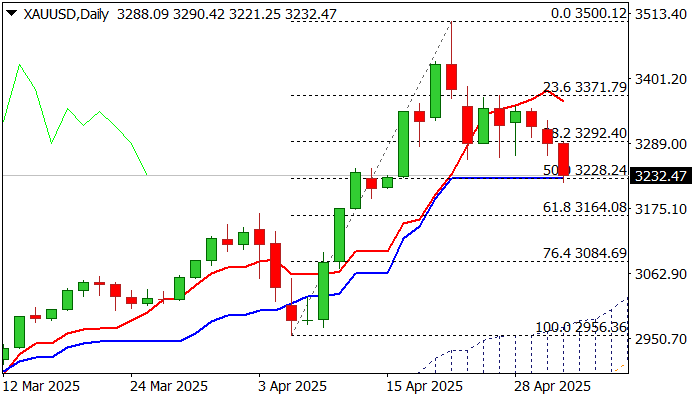

Loss of pivotal $3300 support zone has generated strong bearish signal (daily close below these levels to confirm the signal).

Fresh bears cracked next strong supports at $3230 zone (daily Kijun-sen / 50% retracement of $2959/$3500 upleg), adding to negative near term outlook.

Daily studies show 14-d momentum in a steep fall and approaching the centreline, while daily Tenkan-sen turned south that supports the action.

April’s monthly candle with very long upper shadow also contributes to developing reversal signal.

Firm break of $3230 zone to further weaken near term structure and expose targets at $3200 (psychological) and $3164 (Fibo 61.8%) in extension.

Former spike lows at $3260 mark initial resistances, with $3300 zone now acting as solid resistance which should cap potential upticks and signal positioning for deeper correction.

Res: 3260; 3292; 3300; 3328

Sup: 3221; 3200; 3164; 3100