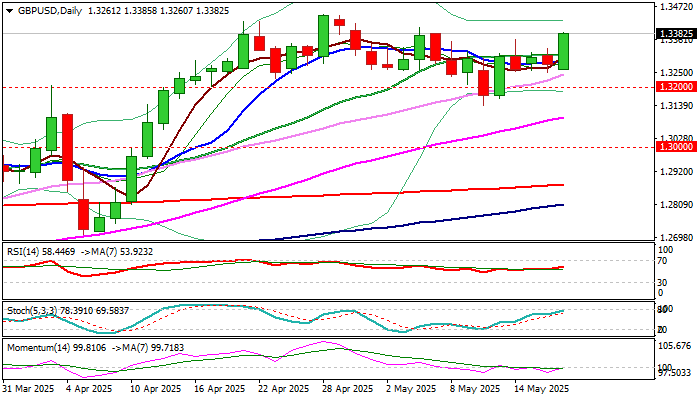

GBPUSD – fresh recovery acceleration opens way for retest of key barriers at 1.3443/44

Cable jumped around a hundred pips on Monday morning, lifted by weaker dollar on surprise US credit rating downgrade and the latest EU/UK agreement on defense.

Fresh advance attempts to break above three-day congestion that would signal continuation of recovery from 1.3139 (correction low of May 12) which has already retraced 76.4% of 1.3444/1.3139 pullback.

Improving daily studies (MA’s returned to bullish setup / rising 14-d momentum is pressuring the centreline and on track to break into positive territory) while firmly bullish weekly studies add to the notion, particularly with bear-trap under Fibo support at 1.3163.

Close above 1.3400 zone (May 6 lower top / round-figure) is needed to validate fresh bullish signal and open way for retest of key barriers at 1.3443/44 (2024/2025 tops) where bulls are likely to face increased headwinds.

Res: 1.3402; 1.3444; 1.3500; 1.3557

Sup: 1.3360; 1.3307; 1.3250; 1.3200