EURUSD remains constructive ahead of ECB; US NFP report

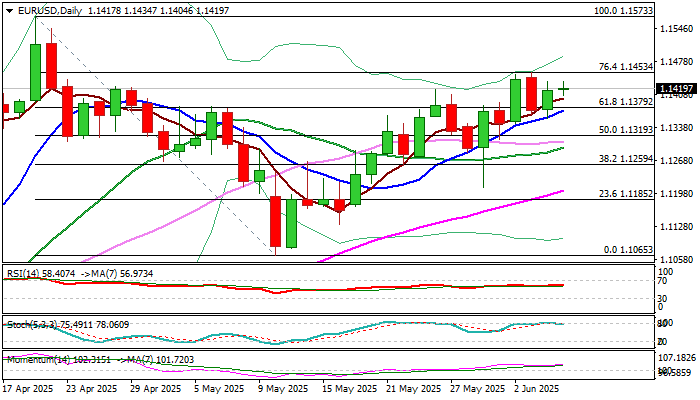

EURUSD holds in extended consolidation under new multi-week high (1.1454) but keeps firm tone that boosts prospects for further growth.

Bullish daily studies (strong positive momentum, MA’s in bullish configuration and thick daily cloud underpinning near-term action) contribute to positive outlook

Rising 10DMA tracks the price action since May 19, and offers solid support at 1.1373 (also near broken Fibo 61.8% of 1.1573/1.1065 pullback) followed by daily Tenkan-sen (1.1332) which should hold dips and keep lower trigger at 1.1286 (daily cloud top) intact.

All eyes are on today’s ECB decision and Friday’s US NFP report which would provide fresh direction signals.

The European Central Bank is widely expected to cut rates by additional 25 basis points and likely to signal pause in its year-long easing cycle until autumn.

Traders will be focusing on President Lagarde’s press conference for more details about ECB’s action in coming months.

Eurozone inflation is at CB’s target zone, however the policymakers remain cautious about potential stronger negative consequences, as escalation of trade war would fuel inflation.

On the other hand, the two recent reports from the US labor sector were mixed, as JOLTS showed stronger than expected results in May while hiring in US private sector slumped last month (ADP report).

US Nonfarm Payrolls rose by 177K in April and economists expect 130K increase in May, though some banks lowered their expectations after disappointing ADP report results that added to growing worries about unexpected NFP drop.

The US dollar is in a downward trajectory and may accelerate losses on NFP miss that would provide fresh boost to the single currency and open way for potential retest of 2025 peak (1.1573).

Res: 1.1453; 1.1473; 1.1500; 1.1547

Sup: 1.1404; 1.1373; 1.1357; 1.1332