DOLLAR INDEX – bears consolidate above multi-month low as markets await releases of key US labor sector reports

The dollar index edged higher from new 3 ½ low on Wednesday, after US JOLTS report surprise jump brightened near term outlook and prompted a partial profit taking

Bounce was so far limited as the dollar remains pressured by uncertainty over President Trump’s massive tax and spending bill (worth $3.3 trillion) which was passed by Senate and needs approval from the House.

On the other hand, Fed Chair Powell reiterated the central bank’s dovish stance (remaining in seat and wait mode to estimate negative impact from US tariffs on inflation and economy) that provides some support to the greenback.

However, the US dollar showed the worst performance in the first six months of 2025 in the decades, impacted by high global uncertainty, de-dollarization process and other factors that prompted traders out of dollar.

More shockwaves are still to be expected as Trump’s tariff deadline ends on July 9 (likely no further extension, according to Trump) with many cases being still open (Japan, India, EU) and threatening of escalation in case of no deal reached in coming days.

Also, persisting conflict between President Trump, who requires the Fed to significantly reduce borrowing cost and provide better environment for investments that would boost economic growth and Fed Chair Powell who resists to follow Trump’s advice, arguing by growing concerns that impact from tariffs would boost inflation this summer, adds to unclear outlook for the US currency.

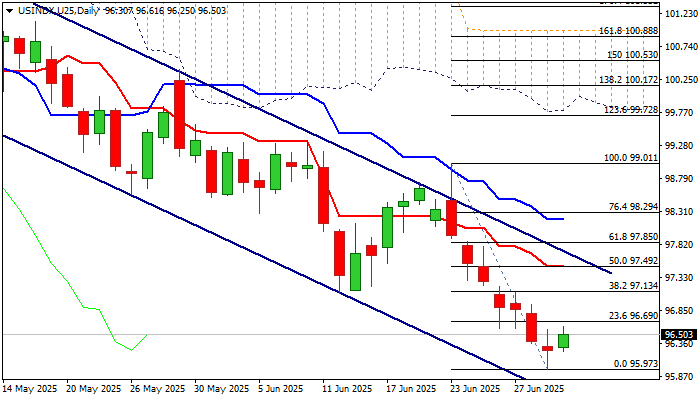

Technical picture on daily chart remains bearish as the price action is weighed by thick daily Ichimoku cloud, daily Tenkan/Kijun-sen in bearish setup and negative momentum.

Also, the price holds near the lower boundary of a bear-channel from 101.80 (May 12 top), that keeps near-term risk shifted to the downside.

Recovery attempts should be ideally capped under 97.50 zone (50% retracement of 99.01/95.97 bear-leg / daily Tenkan-sen / near the upper boundary of bear-channel) to keep larger bears intact.

Renewed attack at new multi-month low (95.97) would generate initial signal of bearish continuation and expose target at 95.18 (Fibo 76.4% of 89.15/114.72, 2021/2022 uptrend).

On the other hand, violation of 97.50 resistance zone would sideline immediate bears and unmask upper triggers at 97.85 (Fibo 61.8%) and 98.18 (daily Kijun-sen).

Res: 96.69; 97.13; 97.50; 97.85

Sup: 96.25; 95.97; 95.18; 94.59