Australian dollar falls sharply on risk aversion ahead of widely expected 25 bps RBA rate cut

AUDUSD remains in red for the third consecutive day and accelerates losses in early Monday (down almost 1% in Asian / early European trading), to hit the lowest in nearly two weeks, on probe below psychological 0.6500 level.

Fresh risk aversion to constant changes in US tariff details undermined traders’ confidence and deflated Aussie dollar, prompting traders into safety of its US counterpart.

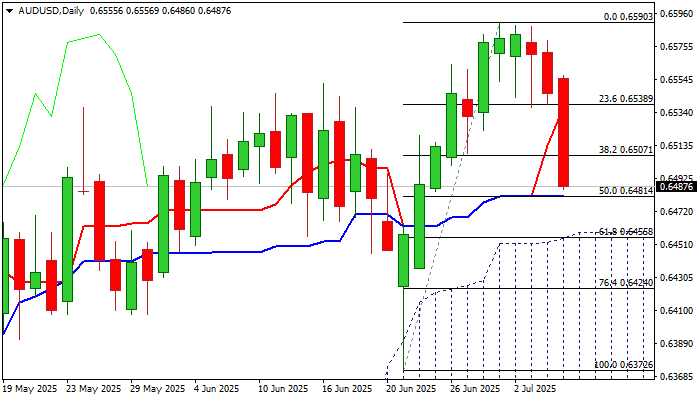

Significant loss of bullish momentum and break below 10 and 20DMA’s (0.6542/0.6519 respectively) weakened technical structure on daily chart, with bull-trap on weekly chart (above Fibo 61.8% of 0.6942/0.5914) adding to negative signals.

Bears pressure daily Kijun-sen (0.6481), ahead of more significant support at 0.6455 (top of thick ascending daily cloud / Fibo 61.8% of 0.6372/0.6590 bull-leg) where bears are likely to face strong headwinds.

Sustained break here would generate strong bearish signal and open way for deeper drop towards 0.6413 (200DMA) and 0.6372 (June 23 higher low).

RBA policymakers meet on Tuesday and are widely expected to deliver a 25 basis points rate cut that would provide additional pressure to Australian currency.

Res: 0.6519; 0.6542; 0.6563; 0.6579

Sup: 0.6481; 0.6455; 0.6413; 0.6372