Dollar remains constructive, weekly close eyed for fresh signal

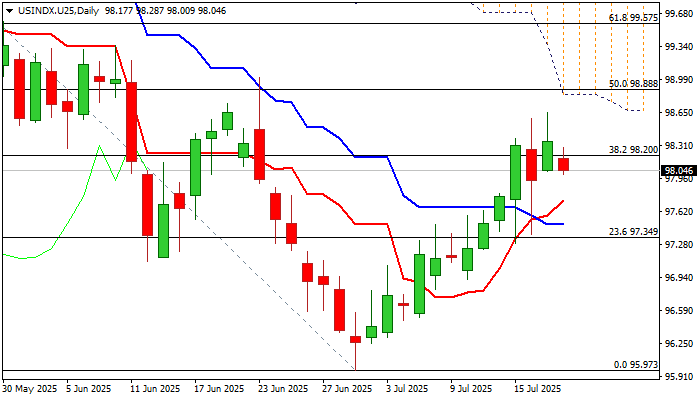

The dollar index keeps overall firm tone and heading for the second straight weekly gain, with some important technical barriers being cracked this week.

However, situation on daily chart indicates that bulls might be running out of steam, after pivotal Fibo barrier at 98.20 (38.2% of 101.80/95.97) has been broken, but fresh upside attempts were repeatedly capped by falling 55DMA (98.56).

Daily technical studies are mixed as positive momentum is strong and daily Tenkan / Kijun-sen formed a bull cross, but the action is weighed by falling daily cloud.

Our focus will be on today’s closing, with weekly close above 98.20 Fibo level to confirm positive signal and keep bulls in play for renewed attempt through 55DMA and attack at next key obstacles at 98.84/88 (50% retracement / daily Ichimoku cloud bases).

Conversely, closing below 98.20 would generate initial bearish signal (bull-trap) and keep the downside vulnerable.

Res: 98.28; 98.56; 98.88; 99.35

Sup: 98.03; 97.66; 97.28; 96.81